|

Replies: 28

| visibility 307

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

The silent, hidden recession we don't even know about

3

Dec 27, 2023, 11:16 AM

|

|

The math is simple. The consequences are predictable. The reaction and measures taken are never mentioned or discussed, and are completely unpredictable. You literally can not short obvious stupidity and problems because you can not account for the Federal Reserve stepping in and erasing the problem.

40% of houses with a mortgage in the US have mortgages with rates under 4%. The current Fed lending rate is over 5%. We had a full year of 6%+ inflation topping out at 9%, and the fed raised rates over 5% in a hurry as a response. It doesn't take a rocket scientist to figure out that those 30-year FIXED rate mortgages financed under 4% are no longer financial assets for banks. This doesn't even include commercial loans and real estate, ALSO financed cheap in 2021.

All of this has been repackaged, resold, and has financed derivatives, just as it did in 2008. In 2008 it was people not being able to pay their mortgages after 5 years of fixed (deflated) rates, that caused a financial crisis, with contagion right to the top (derivative markets). Non-payment of mortgages caused assets to become liabilities en masse. Today, it's inflation. When an "investor" buys a mortgage, or MBS, they're buying the long-term profitability of the loan/mortgage, over time, to guarantee profitable returns. When the underlying assumptions on the mortgage are upended, either through non-payment of poorly-structured loans (2008), or the interest paid on the loan will not keep up with inflation (today), the asset becomes a debt. "Toxic debt" as it was once called.

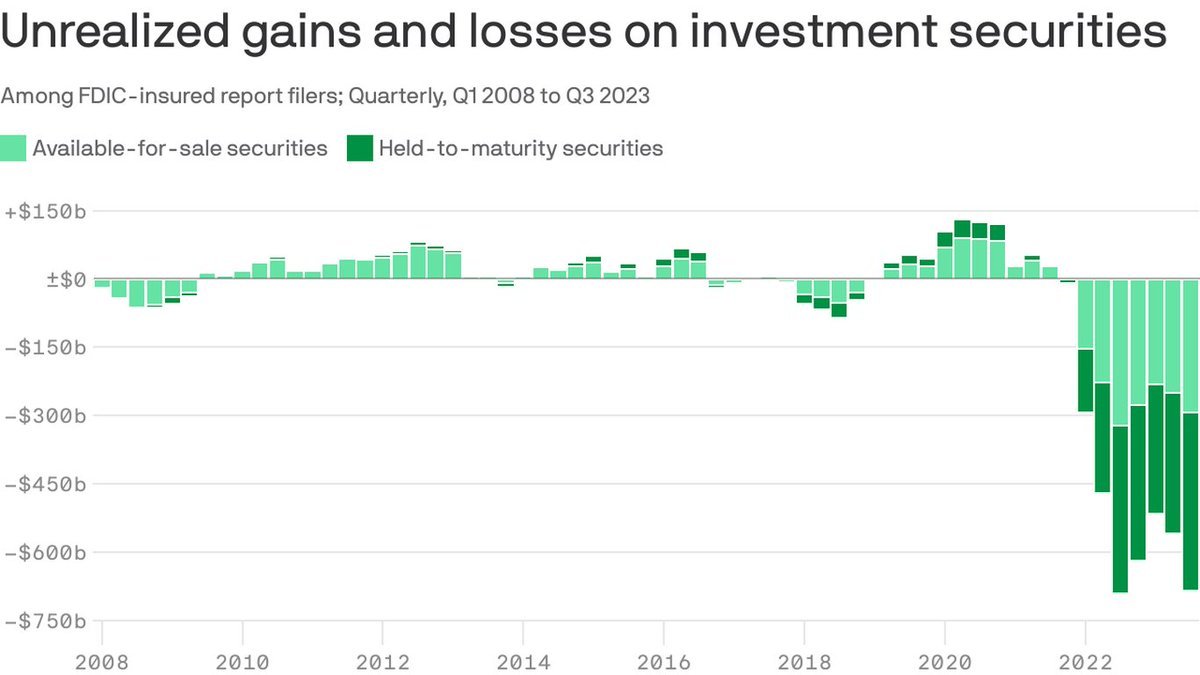

This is happening again, but this time the first dominoes to fall were the lesser-funded and diversified regional banks. The Fed stepped in, as they always do when lenders screw up, and they have floated well over $110 billion in emergency loans, at the rates the mortgages were lent, to recapitalize failing banks. Furthermore, there's at least $600 billion more in liabilities now that have not been addressed by emergency lending. The Fed's emergency lending program is set to expire in March. Had the fed not stepped in, we would have had a banking crisis, a mortgage crisis, and lord knows what else.

Anyway, no one is paying attention to this, as usual. No one paid attention to ####### mortgages from 2003-2008 either. And no one pays attention to what the Fed does when it steps in. And NO ONE KNOWS HOW THE FED RESOLVES THEIR LIABILITIES when they do step in. Hence...the silent/hidden recession. Overall, to date, banks of all sizes have QUIETLY laid off over 60,000 employees. They are bracing for March of 2024. That is when the feces hits the fan again, UNLESS the Fed steps in again and does more. It could extend the emergency lending program, or grow it, and there will be a blurb in the media, and that's it, and we will carry on in our usual blissful ignorance.

This article hints at the problems.

https://www.wsj.com/finance/banking/banking-crisis-plays-out-at-americas-smallest-lenders-0a73211c

|

|

|

|

|

All-Time Great [91427]

TigerPulse: 100%

63

Posts: 62758

Joined: 2004

|

It doesn't really matter as long as the loans continue to be repaid.

3

Dec 27, 2023, 11:23 AM

|

|

And as someone who bought a few houses in the last 3 years (and tried to buy potentially a dozen more), I can attest that there are no more days of falsifying your employment information, or making up equity/down payment numbers. Those days are over. One must have real money or at least equity to be able to buy a house. There's not a way around that, at least as far as I am aware.

Anyone who bought or refinanced a house in (at least) the last 3 years has a vested interest in their house--and as such, an interest in not seeing their equity just "go away" by frivolously stopping their payments and walking away from the responsibility of fulfilling what their loan contract demands.

|

|

|

|

|

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

You missed the part where I said this isn't a crisis from a lack of payments

1

Dec 27, 2023, 11:54 AM

|

|

on the part of the borrower. That was 2008. This is the actual "value" of the loan, to the lender, has dissolved, and that value is now a liability, due to inflation and higher fed lending rates. I promise no one, whoever owns my 15-year fixed 2.125% mortgage, no one will make a profit on that because in 15 years the value of the mortgage repayment won't even match inflation, much less turn a profit to whoever owns the debt.

$600 billion and counting. $130 billion has already been loaned to banks as emergency lending by the Fed. That is keeping the lenders solvent in the face of massive losses over time on mortgages. Nope, the crisis we have today was due to ####### loans at ####### rates, confronted with high inflation and much higher fed rates. Not the fact the loans can't be repaid. They can. BUT that repayment no longer represents a profit, or an asset to the lender, but a debt. Same stress on the financial sector, just a different mechanism causing the stress.

This either causes a banking and financial crisis, with wider contagion, OR it is patched over and over time, as houses have to be sold and hopefully much more new ones are built, and new more profitable loans come into existence, will slowly erase the losses. This could be a 10-year (or longer) process. Assuming they can keep a crisis under the carpet that long.

|

|

|

|

|

|

All-Time Great [91427]

TigerPulse: 100%

63

Posts: 62758

Joined: 2004

|

If what you say is true, this could have been a "silent recession"

1

Dec 27, 2023, 12:34 PM

|

|

Since the very first house ever was sold with a mortgage.

Money was made with that loaned money when the house was sold; had the mortgage company been able to make more money in the market or doing anything else at the time; they would have.

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

The value is not a liability, it has just shrunk. Like anyone with bonds

3

Dec 27, 2023, 1:08 PM

[ in reply to You missed the part where I said this isn't a crisis from a lack of payments ] |

|

values are down. Now, lenders will have to devalue these assets on their balance sheets and recognize losses most likely. They might unload the mortgages and actually realize those losses. Using the words that a loan which is an asset is now a debt just makes me shiver, sorry. It is still an asset, just an under performing one.

|

|

|

|

|

|

Orange Immortal [68403]

TigerPulse: 100%

60

Posts: 15934

Joined: 2018

|

Right, the difference between them making a few less points and them making

1

Dec 27, 2023, 1:11 PM

|

|

zero because mortgage holder quit paying is enormous. Not same ballpark.

|

|

|

|

|

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

Exactly what I said. Assets that are now underperforming.***

1

Dec 27, 2023, 1:17 PM

|

|

|

|

|

|

|

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

Every crap mortgage from 2003 until 2008 was an asset.

Dec 27, 2023, 5:02 PM

|

|

Until it became "toxic debt". They performed brilliantly until they became adjustable at 5 years. Then they became worthless. A LIABILITY. If I invest our savings into bitcoin at $40K and it drops to $1K, that bitcoin is NOT an asset anymore. Every day it drops, it's a liability (I'm losing money). You are in effect paying money (losing money). It represents a net loss, so however you want to label it, it's a liability. It's money you once had, that you don't have anymore.

You lend your crackhead cousin $1,000 to go buy a new suit for a job interview. Hoping he gets the job and can pay you back as promised. Instead he takes the $1K and buys crack, doesn't get the job, and you lose the $1K. Your cousin went from being an asset to a liability in that scenario. You only chose to call him an asset based on the assumption he gets a job with your money and pays you back.

Then entire financial meltdown in 2008 was because investors saw mortgage backed securities as assets. The bigger the mortgage, the more you lend, the greater the asset. This made a lot of crooks think they were rich. You have this loan, for more than the buyer can afford, but that's ok. Just get him signed up to all he can afford on the front end with 5 years interest only, then rake in the big bucks after 5 years when the rates adjust. That "asset", those loans, those MBS, started defaulting as the rates adjusted at 5 years, And people couldn't afford them. That "asset" the lender assumed existed, failed to produce. It became a liability. It almost wrecked the financial sector.

I signed a 2.125% 15yr mortgage in a lawyers office. Lawyer said the rates were insanely low. He was happy. He's getting business. He and I both agreed though that whoever issues, and sells this loan, or buys it, over 15 years, it will NOT remain an asset for the lender. The lender can not make money on my mortgage. As I'm signing the documents I'm thinking this is great for me, but at the same time I'm thinking the lender almost assuredly loses on this. And they did. In 2003 my best friend tried mightily to steer wife and I into a sub-prime mortgage for $400K. He did that because that loan was a greater asset to his company, the lender. They could make more reselling it as it's packed into MBS. We declined. He made less money on our mortgage. Selling us a 30yr was not as big of an asset to his company. They couldn't sell it for as much, or make as much money on that "asset". This idea that something is an asset based on paper or promises does not always work out long term. IN my 2003 mortgage example, in that case I realized that BOTH my wife and I, AND the lenders, would lose on these mortgages. That's the difference, something I mentioned to IE below earlier. In 2003 you had buyers with homes under water, trying to sell in a flooded market, losing money, and going broke paying mortgages they couldn't afford, AND you had lenders doing the same. This is different. This time it's inflation that hit that killed the asset, not people defaulting on their mortgages. The losses are tilted to the lender in the 2021 refinancing scenario. Great deal for the borrower. A mediocre deal under the best inflation scenario for the lender, but a massive loss if there is inflation.

So when banks started failing in March 2023, and people couldn't get their money from the bank, due to "underperforming assets", well, that's what happened and would have continued happening but for the Fed stepping in. This is why I cringed when my home, my "asset", started skyrocketing in value in 2021. Everyone thinks that's a great thing until they have to turn around and buy a new home after selling their own. I can't afford to sell my house, take my equity, put 100% towards buying a new house, financing the difference, and keeping my mortgage payment the same. Can't be done. Either new homes have to be built, or rates drop, or inflation drops, or property values drop, one (or all) of those things have to happen for me to be able to afford to sell my house, and move into a similar sized/valued house. Even my house, my "asset" with an increased value, is actually a liability to me now, in this market. If I sell it, and buy it right back for the same price, and finance the difference, I'm paying $1,800 a month MORE than I am currently paying. So no one is selling. IS it an asset now? If I sell it, and try and buy something similar, it's like buying the entire house all over again, but at a mortgage that's double. IS that an asset? I'd say not.

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

They are not 'worthless'. LOL. And yes, if you invest in Bitcoin

Dec 27, 2023, 5:27 PM

|

|

and it now is worth less, it is still worth something.

A liability is something you owe - you borrow money, you owe money. An asset is something you own, and its value can increase or decrease, but that does not make it a liability.

You have a weird way of looking at this.

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

So, what happens when interest rates start to go back down?

Dec 27, 2023, 5:28 PM

|

|

which they have. Loans made at 8% are assets but loans made at 4% are liabilities?

No, sorry.

|

|

|

|

|

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

The amount that are assets rises, and liabilities drop.

Dec 27, 2023, 6:23 PM

|

|

If your rate is below inflation, that's not good. But also keep in mind mortgages are 30-year financial instruments, in the US anyway. But I see no way anyone would make much, if any money, on a 2.125% 15-year mortgage, even if we never had inflation.

Little known fact. There is only ONE country on Earth where 30 year fixed rate mortgages even exist. There are only 5-6 countries that even have (shorter) fixed mortgages. Some European countries offer 5, 10, and rarely 15 year fixed mortgages. The rest of Earth, rates adjust.

And make no mistake, the rest of the countries out there, beyond our shores, people are TRULY hurting, bad. Canada especially. AND, this forces people to sell their houses, which while bad, actually creates a more solvent situation for lenders. Not here though.

We try and tease people with lower rates with ARMS in the US, because for the lender, that is a more secure loan.

|

|

|

|

|

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

I'll defer to Google.

Dec 27, 2023, 5:44 PM

[ in reply to They are not 'worthless'. LOL. And yes, if you invest in Bitcoin ] |

|

Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!

But here's the key, and our problem. You can take an asset, and take out loans on an asset, and when that asset tanks, so does the loan.

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

LOL. I'll defer to my 40 years of being an accountant.

4

Dec 27, 2023, 6:17 PM

|

|

Assets are anything you own, may or may not have value. Liabilities are amounts you owe to other parties. Your assets less your liabilities are your net worth or equity.

Assets can go up and down in value, they do all the time. This does not make them liabilities.

I will die on this hill by the way.

|

|

|

|

|

|

All-Time Great [91427]

TigerPulse: 100%

63

Posts: 62758

Joined: 2004

|

its kind of an accounting rule.

Dec 28, 2023, 12:11 AM

|

|

Assets=liabilities+owners equity

|

|

|

|

|

|

Ultimate Tiger [34264]

TigerPulse: 100%

56

Posts: 17391

Joined: 2014

|

Re: LOL. I'll defer to my 40 years of being an accountant.

Dec 28, 2023, 1:15 AM

[ in reply to LOL. I'll defer to my 40 years of being an accountant. ] |

|

I think the confusion is the effect expenses related to investment loss have on equity, but yeah that doesn't turn the investment into a liability.

|

|

|

|

|

|

Orange Immortal [64530]

TigerPulse: 100%

60

Posts: 44304

Joined: 1998

|

it's an asset......but to your heirs, not yourself right now

Dec 27, 2023, 5:36 PM

[ in reply to Every crap mortgage from 2003 until 2008 was an asset. ] |

|

in this economy, its peak value is if/when the day comes that you don't need it any more, and don't need a replacement residence. Then it can be sold as a true asset.

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

I do not want you guys to ever do a personal balance sheet

1

Dec 27, 2023, 5:39 PM

|

|

for me.

|

|

|

|

|

|

Ultimate Clemson Legend [109475]

TigerPulse: 100%

64

Posts: 71015

Joined: 2002

|

I don't own squat.

1

Dec 27, 2023, 6:32 PM

|

|

Well, house. Cars, contents of house. About it.

|

|

|

|

|

|

All-Time Great [91427]

TigerPulse: 100%

63

Posts: 62758

Joined: 2004

|

|

|

|

|

|

TigerNet Eternal Icon [187982]

TigerPulse: 100%

70

Posts: 37562

Joined: 2007

|

|

|

|

|

|

All-Time Great [91427]

TigerPulse: 100%

63

Posts: 62758

Joined: 2004

|

I think that depends on who is doing the accounting.

Dec 28, 2023, 8:59 AM

|

|

Our company capitalizes labor (that is used on projects, anyway), so "Generally Accepted" isn't really a good rule of accounting principles any more.

|

|

|

|

|

|

TigerNet Elite [72691]

TigerPulse: 100%

61

Posts: 25545

Joined: 2017

|

Re: It doesn't really matter as long as the loans continue to be repaid.

Dec 27, 2023, 10:36 PM

[ in reply to It doesn't really matter as long as the loans continue to be repaid. ] |

|

Finally agree with you on something.

I might add and not saying you endorse this, but as much as Bush was hated, he was politically pressured to make mortgages and homes more attainable for minorities. He pandered and we all lost.

|

|

|

|

|

|

1st Rounder [665]

TigerPulse: 92%

21

|

Re: It doesn't really matter as long as the loans continue to be repaid.

Dec 28, 2023, 8:56 AM

|

|

The 2008 crisis did not happen because Bush was pressured into increasing minority homeownership. You should be smarter than that.

|

|

|

|

|

|

Orange Immortal [65668]

TigerPulse: 100%

60

Posts: 38943

Joined: 1998

|

Our whole economy has been propped up by QE and fiat currencies

2

Dec 27, 2023, 1:12 PM

|

|

for far too long.

Somehow (wars, discrimination, national bank shenanigans, etc.) we have been able to keep the inevitable crash at bay.

That doesn’t mean we will be able to do so forever.

All of the smartest people and the preppers know this. It’s not if, it’s when.

Luckily, as the Prophet Bocephus spake years ago, my people will be ahhite.

https://youtu.be/3cQNkIrg-Tk?si=LSaIOMtNm-NF0T2T

|

|

|

|

|

|

Ultimate Clemson Legend [104812]

TigerPulse: 100%

64

Posts: 29531

Joined: 2014

|

Good luck catching them quinoa catfish in virginia waters***

2

Dec 27, 2023, 1:15 PM

|

|

|

|

|

|

|

|

Orange Immortal [65668]

TigerPulse: 100%

60

Posts: 38943

Joined: 1998

|

We got dandelions and poke salat in abundance.***

1

Dec 27, 2023, 1:18 PM

|

|

|

|

|

|

|

|

Orange Immortal [65668]

TigerPulse: 100%

60

Posts: 38943

Joined: 1998

|

And a cash crop - weed.***

1

Dec 27, 2023, 1:18 PM

|

|

|

|

|

|

|

|

Top TigerNet [30520]

TigerPulse: 100%

55

Posts: 11812

Joined: 2011

|

I think the difference here is it's not just

Dec 27, 2023, 10:25 PM

|

|

Mortgages, like in 2008. It's everything. All bank assets that they're required to hold per Fed stress test requirements are tanking in value due to the Fed raising rates. That's why the Fed did the BTFP facility.

We've been raising rates and doing QE this whole time. And spending more gov money.

Whole thing is ######. Economy is ####

|

|

|

|

|

|

Replies: 28

| visibility 307

|

|

|

to award

the award.

to award

the award.