|

Replies: 52

| visibility 4096

|

Orange Phenom [14595]

TigerPulse: 100%

49

|

Our Federal debt is $34.5 trillion and growing

4

Aug 21, 2024, 10:09 PM

|

|

Our debt is now 122% of GDP - well past the 77% mark that many economists believe to be a safe investment... In 2025, paying the interest on this debt will be greater than our current Defense budget. In 2025, $.75 cents out of every $1.00 of Federal Income tax collected will have to be used to make interest payments on that $34.5 trillion in debt. That only leaves $.25 out of every $1.00 in Federal Income tax collected to pay for the entire Federal Budget. Of course that $.25 won't come anywhere close to funding our Federal budget so we are going to simply print or borrow more money to make the debt even higher resulting in ever higher payments to service this debt.

At this rate we are quickly coming to a point where every tax dollar collected will be needed just to make the payments on the debt. What happens then?? Do we borrow more money just to make the debt service payments and to fund the Government?? Kind of like paying the monthly master card debt interest by borrowing from the visa card...

Every Congress, at some point, has a fight over raising the debt ceiling. Every time this fight happens we get a string of US/world economic doomsday warnings if we fail to raise that limit and make our debt payments (i.e. default on the debt). Well.... what is going to happen when it's not the semi-annual debt ceiling argument in Congress that prevents us from making those debt payments but the fact we don't have enough incoming tax dollars to service it?? What happens when no one wants to lend the USA money because we owe more in debt interest payments than we collect in tax dollars?? We are quickly approaching this point.

So...W.T.F are our two political parties, their Congressional candidates and our Presidential candidates going to do about this debt ticking time bomb? Well... if you look at all the shid the candidates are talking about, the election focus from the Corporate Media, the policy statements of both Party's - not a f**king thing is going to be done about the debt. In fact - it's as if the debt doesn't exist and this "be and do everything for everybody" Federal Government that relies on a borrow, print and spend beyond our means existence can go on forever.

For the past 24 years the Democrats have not given a real shid about the debt. During election season the Republicans pretended to care about the debt but quickly shidcanned any ideas of really doing anything about it once the elections were over.

So here we are in 2024 where we have finally gotten to the point that neither Party is even bothering to talk about the debt. Everything else under the sun is called a "crisis" (climate crisis, drug crisis, health crisis, border crisis etc...) by our political class except for the one thing that really is reaching a crisis stage - the Federal debt. I guess both Parties have just given up on the idea of doing anything about the debt and plan to ride this sinking Federal debt ship all the way to the bottom of the ocean.

I am beyond frustrated with our political class. Someone tell me how this ends. At what US debt to GDP ratio point does our ability to borrow stop and the fiscal fall of the USA begins??

|

|

|

|

|

Ultimate Clemson Legend [105019]

TigerPulse: 100%

64

Posts: 68642

Joined: 2002

|

And this is why inflation sucks so bad.

Aug 21, 2024, 10:21 PM

|

|

We're spending all this at 5.25%. What if we somehow got 15% inflation? Volcker jacked rates up to close to 20% in the 80s to break the 70s inflation. We can't do that. Any rate over 8% and we're screwed. 10% and solvency is an issue.

What will happen is it will be raised forever because no party will ever hold the line and shoulder the blame for the inevitable.

If things get really bad, the US Treasury will just mint a $1 Trillion coin. Deposit them in the treasury and deem the debt repaid. Yes, that has been seriously proposed.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: And this is why inflation sucks so bad.

Aug 22, 2024, 12:15 AM

|

|

The poster is sadly misinformed on those numbers. The situation is nowhere near as bad as the mid-90s. It could get that bad by 2040 at the current Trend.

|

|

|

|

|

|

Ultimate Clemson Legend [105019]

TigerPulse: 100%

64

Posts: 68642

Joined: 2002

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: The Federal Reserve and the US Treasuey seem to agree with his numbers.

Aug 22, 2024, 7:53 AM

|

|

It’s not a quarter either. You might be mixing things up and comparing net interest to discretionary spending. Total spending is 6-7 trillion dollars. I remember it being about 30% of discretionary in the mid-90s.

The most I got for I-bonds was 9.6% when inflation was high, but only for a few months. It’s 4.28 now. That’s the highest rate the government pays, but those are a small fraction of the total. You can invest 10k direct plus another 5k from a tax refund. Some people overpay taxes just to get that extra 5k into I bonds.

|

|

|

|

|

|

110%er [3647]

TigerPulse: 100%

35

|

Re: The Federal Reserve and the US Treasuey seem to agree with his numbers.

Aug 22, 2024, 8:28 AM

|

|

What are I bonds?

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: The Federal Reserve and the US Treasuey seem to agree with his numbers.

Aug 22, 2024, 8:28 PM

|

|

Inflation adjusted bonds. You can buy them any time from treasurydirect.gov, but only $10k per year directly and up to another $5k by directing your tax refund to them. There isn't a secondary market for them, you can only buy and sell to the government. They were introduced at a time of very low inflation, so many forgot about them. There are other options for inflation protected bonds, but they are only sold on auction days and the rate was lower, at least during the recent period of high inflation.

|

|

|

|

|

|

Ultimate Clemson Legend [105019]

TigerPulse: 100%

64

Posts: 68642

Joined: 2002

|

You're getting bogged down with discretionary spending.

Aug 22, 2024, 9:23 AM

[ in reply to Re: The Federal Reserve and the US Treasuey seem to agree with his numbers. ] |

|

That's a label placed by Congress to absolve themselves from responsibility. Discretionary, non-discretionary, that's all dollars, and they both apply to the debt, and they both apply to the payment (revenue) we spend servicing our debt which includes discretionary and non discretionary spending.

The current year is estimated at 25%. Was 22% last year I think. You can take that federal reserve graph and figure out the percentage of total revenue.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: You're getting bogged down with discretionary spending.

Aug 22, 2024, 8:19 PM

|

|

No, you are still misinterpreting it. Which graph are you divining this information from?

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: You're getting bogged down with discretionary spending.

Aug 22, 2024, 8:32 PM

[ in reply to You're getting bogged down with discretionary spending. ] |

|

Discretionary is spending not required by law, like the defense budget. Mandatory is spending that has been guaranteed by law, including social security and medicare. The mandatory side is fixed and can't be reduced without passing new laws. The discretionary side is where any budget cuts and the jockeying for funding between agencies happens.

|

|

|

|

|

|

Paw Master [16578]

TigerPulse: 100%

51

Posts: 10302

Joined: 2016

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: And this is why inflation sucks so bad.

Aug 22, 2024, 8:37 PM

|

|

You people are really gullible. Somebody throws around a few numbers and put a few percentage signs on some of those numbers, and you think the information was brought down from the mountain on graven tablets.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

|

|

|

|

|

Paw Master [16578]

TigerPulse: 100%

51

Posts: 10302

Joined: 2016

|

Re: And this is why inflation sucks so bad.

Aug 24, 2024, 5:02 PM

|

|

Thanks for the link. It's nice, Government Assets less than $5.5 Trillion and Liabilities of ~$44 Trillion. That's healthy.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: And this is why inflation sucks so bad.

Aug 25, 2024, 1:33 AM

|

|

Like oil companies, the assets are not what they appear to be. An oil company can own the rights to a field that is likely to produce hundreds of millions of dollars in oil and gas. As an asset, those rights are only valued at what they cost to acquire. The point here is that all the natural resources on public lands and waters are not counted in the assets for what they are really worth, only the cost of acquisition. When Trump was in office, he tried to get some movement in selling off public land, while trying to buy Greenland for some syphilitic reasoning.

IP is treated the same. A patent can generate millions, but it's only valued on the books at the development and legal costs.

|

|

|

|

|

|

Ultimate Clemson Legend [105019]

TigerPulse: 100%

64

Posts: 68642

Joined: 2002

|

This is a problem that can't be fixed except with Article V.

Aug 21, 2024, 10:25 PM

|

|

I honestly think that's the only viable solution. Congress will never fix it. This is a standard, age old democracy problem. Only the states can fix this.

|

|

|

|

|

|

National Champion [8072]

TigerPulse: 100%

42

Posts: 10411

Joined: 2013

|

Yeah, we've essentially legalized political bribery.

Aug 21, 2024, 11:00 PM

|

|

Thanks to citizens united and our lenient campaign finance laws, big money can buy politicians (and SCOTUS judges!) to pass favorable legislation and hand out those sweet sweet government contracts. The donor class gets richer, politicians get richer, and normal people get the bill.

|

|

|

|

|

|

National Champion [8072]

TigerPulse: 100%

42

Posts: 10411

Joined: 2013

|

On a more lighthearted note,

Aug 21, 2024, 11:02 PM

|

|

I had a GW econ professor argue that the US should just default on the debt cause it's not like the world is just going to stop doing business with or loaning money to the US. For those who don't know, the GW econ department is almost libertarian and nobody takes them seriously.

|

|

|

|

|

|

Heisman Winner [86992]

TigerPulse: 100%

62

Posts: 81368

Joined: 1999

|

Good post but who is more to blame, the two

Aug 21, 2024, 11:16 PM

|

|

political parties or the electorate?

Let's say a candidate runs for president in either party's primary and his/her campaign advocates putting caps on Medicare, Medicaid, defense, and raising the SS age. They won't do very well.

The last two people I remember pushing capping these programs were Paul Ryan and Joe Scarborough about 15 years ago.

|

|

|

|

|

|

Ultimate Clemson Legend [105019]

TigerPulse: 100%

64

Posts: 68642

Joined: 2002

|

It's pretty clear who is to blame.

Aug 22, 2024, 6:05 AM

|

|

It stinks, but it's the American people.

|

|

|

|

|

|

Ultimate Tiger [33983]

TigerPulse: 100%

56

Posts: 38436

Joined: 2003

|

yep, pretty much***

Aug 22, 2024, 7:45 AM

|

|

|

|

|

|

|

|

Tiger Titan [47389]

TigerPulse: 100%

58

Posts: 42379

Joined: 1998

|

Hard to lock that down...

Aug 22, 2024, 7:49 AM

[ in reply to Good post but who is more to blame, the two ] |

|

I do think there is a portion of the electorate that really cares about it and they get duped, but many don't understand it and ask for more spending. Your average Trumpkin will pretend he wants less spending, but then he'll celebrate very costly proposals for the border, our military, and other increases to government spending.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

1

Aug 21, 2024, 11:52 PM

|

|

Where the f*ck are you getting your information? Straight from the Kremlin?

75 cents for every dollar of tax revenue spent on net interest? Only in some Trumper fever dream.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 12:09 AM

|

|

Trying to figure out somebody could be so misinformed. For the net interest to be 75% of revenue, that would be about 3.4 trillion of interest for 2025. With debt around 34 trillion, that’s roughly a 10% interest rate. But actual net interest is projected at 288 billion in 2025. Gross interest projected at 457 billion, but part of that goes back to government trust funds and the government earns another 61 billion from federal loans and credit.

By the way, it was a LOT worse at the peak in 1996. Clinton and a Republican Congress did a lot of good work on this before Bush unravelled it all. Didn’t know this till tonight, but 51 million US jobs have been created since 1989: 50 million under Democratic presidents and 1 million under Republican presidents.

|

|

|

|

|

|

Ultimate Clemson Legend [105019]

TigerPulse: 100%

64

Posts: 68642

Joined: 2002

|

It's 25%. He got them backwards.

Aug 22, 2024, 6:13 AM

|

|

I posted the charts. This is why inflation is so dangerous. And also why the higher it goes the less Powell can raise rates.

Our best means of lowering inflation is importing more and importing domestic labor.

Irony the job numbers we've all been given, that were 800K off over the past year, BTW, those gains were mostly foreign workers.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: It's 25%. He got them backwards.

Aug 22, 2024, 8:04 AM

|

|

I think you posted the wrong charts. I see total interest payments in your chart, but about 20% of that goes back to government trust funds and gets shifted on the balance sheet instead of paid out. Then the government earns interest. You subtract both of those numbers from the total to get net interest. If I get time, I’ll do a proper analysis and show you how.

|

|

|

|

|

|

TigerNet Champion [118709]

TigerPulse: 100%

65

Posts: 76639

Joined: 2003

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 12:06 AM

|

|

yeah, when it gets to 50 we will probably start to see hyperinflation, that would be a good time to put yourself into debt.

|

|

|

|

|

|

Ultimate Tiger [33983]

TigerPulse: 100%

56

Posts: 38436

Joined: 2003

|

Not saying the debt isn't way too high, but your math is off...

Aug 22, 2024, 7:46 AM

|

|

on the interest. It's not 75% of revenue.

|

|

|

|

|

|

Tiger Titan [47389]

TigerPulse: 100%

58

Posts: 42379

Joined: 1998

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 7:47 AM

|

|

For the past 24 years the Democrats have not given a real shid about the debt. During election season the Republicans pretended to care about the debt but quickly shidcanned any ideas of really doing anything about it once the elections were over.

That's the crux of it. The Dems foolishly don't give a ####; the Republicans lie about it. That's why neither Harris nor Trump is the answer.

I wish we could get a presidential candidate who actually really cared about that for once.

|

|

|

|

|

|

Associate AD [1061]

TigerPulse: 96%

25

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 8:17 AM

|

|

I wish all of you had been this concerned in the 80's when St. Ronnie ran up the debt in his ruckus with the "evil empire". It was a problem then but few were paying attention.

|

|

|

|

|

|

110%er [3647]

TigerPulse: 100%

35

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 8:32 AM

|

|

Many of us weren’t alive in the 80s. I was born in 89’.

|

|

|

|

|

|

Tiger Titan [47389]

TigerPulse: 100%

58

Posts: 42379

Joined: 1998

|

I remember, albeit I was a kid

Aug 22, 2024, 9:06 AM

[ in reply to Re: Our Federal debt is $34.5 trillion and growing ] |

|

I can excuse the spending when it comes to the greater safety and good of America (and the world) AND it's actually a legitimate argument for it. Reagan did it to finally end the USSR, and it was a long overdue measure to put an end to the Cold War.

I differentiate that from wasteful, unnecessary military spending like Iraq.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: I remember, albeit I was a kid

Aug 23, 2024, 8:24 PM

|

|

Reagan was a decent actor and I actually voted for him. I think Bonzo was a little smarter.

|

|

|

|

|

|

Ring of Honor [21319]

TigerPulse: 100%

53

Posts: 12313

Joined: 2002

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 24, 2024, 7:54 AM

[ in reply to Re: Our Federal debt is $34.5 trillion and growing ] |

|

The difference is that Reagan did it by policy, out in the open - he SAID he was doing deliberate deficit spending - and he did it because at that point the Soviets had something like 55,000 tanks parked on the East German border...and all of NATO put together had maybe 14,000.

We were outgunned, we were heavily outnumbered, and the Soviets were not going to be deterred by somebody putting a daisy in the barrel of their Kalashnikov. Then - as now - the only thing they ever responded to was strength. Otherwise they rolled right over you.

It was spend or die, at that point. If they'd ever gotten to a point they thought they could taken Europe they would have rolled. And they were getting close.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 24, 2024, 2:02 PM

|

|

I still think his policy of a weak dollar was the biggest mistake of the 80s. His economic advisors did it to make imports more expensive and support US products. But what we got was so much foreign investment in purchases of real estate and other businesses. Imported cars got more expensive, at a time when domestic car quality was at its lowest point ever.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 24, 2024, 2:05 PM

|

|

Not the biggest mistake. Probably the biggest mistake was promoting radical Islam to support the Mujahideen against the Soviets (read Ghost Wars, it's a good book). That morphed into the Taliban and eventually Al Qaeda after Bush I parked troops in Saudi. Bush II gave us ISIS, can't blame that on Regan and Bush I.

|

|

|

|

|

|

CU Guru [1521]

TigerPulse: 100%

30

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 8:57 AM

|

|

I really don't think most people can argue with this mainly because we (I) really can't get my head wrapped around it. When you stat throwing out numbers in the trillions, percentages, rates, most people glaze over in the first paragraph.

I remember Sam Donaldson back in the 80's-90's saying something like the news should devote more time on the economy. The problem being, after 5 minutes most would change the channel.

The national debt, deficit, debt ceiling etc. only seems to be relevant to the party that is currently out of office. Heard the Dems all through the Reagan-Bush years complaining about it. Once Clinton took office, it was almost as if it never existed in the first place. Yet, the Reps at the time would remind us all. And that seems to have continued.

But even more simplistically than dollars and cents, we are reaching (reached?) a point where there are more people drawing out of the system than putting in. When Social Security was enacted there were 16 people working and contributing for every 1 person drawing out. Now it is closer to 2:1. Every economist I've read agrees that if you have been retired for 3 years, you have drawn out every dime you have paid into that system. After that, it takes people still in the workforce to fund that. I argued with my father over this until his death. No way that is possible! But it is. Think about the rate you were "contributing" when you first started working. Maybe a hundred or so a month, if that. Now you are drawing out around $2,000 or better (or worse) per month.

Social Security is just ONE of the white elephants in the room at both conventions. The only programs anyone wants to cut are the ones that don't impact them. Who's willing to take one for the team?

|

|

|

|

|

|

Associate AD [1061]

TigerPulse: 96%

25

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 9:30 AM

|

|

Who's willing to "take one for the team".

Not lobbyists. Not major corporations. Not the military. So yeah, just go ahead and cut social security in half since rich people don't need it.

|

|

|

|

|

|

CU Guru [1521]

TigerPulse: 100%

30

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 10:05 AM

|

|

I wasn't advocating cutting Social Security. It was simply an example to our governments "nothing to see here" policy when it comes to spending.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 23, 2024, 8:28 PM

|

|

Social Security is still self-funding. The trust fund will eventually run out, but we could do what we did in the 80s - increase the SS tax. It doubled while Reagan was president, but to be fair some of the increases were planned before he came into office. Right now, the two options are to increase the rate for everybody or remove the cap. We already removed the cap for medicare years ago.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 25, 2024, 10:36 PM

[ in reply to Re: Our Federal debt is $34.5 trillion and growing ] |

|

The three years didn’t sound right, so I checked with my account and projected payments at 67. At that point it will take 11.75 years to pay me what my employers and I put in, disregarding any interest. If I take it at 62, it will take 14.2 years. Roughly halve those periods if you don’t want to include the tax the employer pays on my behalf.

I’m sure it’s different for everyone. Maybe three years is an average or median.

Thanks for the inspiration. I’ve been debating on whether to take it early when that time comes. Assuming I live to 80, I’ll collect a cumulative $26k more by waiting till 67 vs taking it early at 62. But if I live to 75, I’ll collect $43k less. But that means earning less than $17k per year in wages in order to take it early. Pensions, investments, rental income, etc. don’t count in that math.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 25, 2024, 10:38 PM

|

|

The earnings cap is 22,320 now before they reduce benefits

|

|

|

|

|

|

Clemson Conqueror [11438]

TigerPulse: 100%

46

Posts: 11298

Joined: 2013

|

Re: Our Federal debt is $34.5 trillion and growing

1

Aug 22, 2024, 3:49 PM

|

|

the plan is to crash the system, rebuild it differently

|

|

|

|

|

|

Clemson Conqueror [11106]

TigerPulse: 98%

46

Posts: 13418

Joined: 2021

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 22, 2024, 9:44 PM

|

|

^^^^ is the primary purpose for the WEF to push ‘The Great Reset’ plan.

The big Western economies and Japan don’t see a way out of it, but still have some room to keep inflating the debt bubble and deal with inflation for some (who knows how much longer?) additional time. When things fall apart in one of the Western / Japan ‘old guard’ financial giants, then the others will quickly follow. The Great Reset is intended to be timed before that first domino falls.

This is analogous to Mardi Gras excesses, followed by the denials of selected personal pleasures when Lent arrives.

|

|

|

|

|

|

Legend [6615]

TigerPulse: 100%

41

Posts: 11242

Joined: 2003

|

Re: Our Federal debt is $34.5 trillion and growing

1

Aug 22, 2024, 10:22 PM

|

|

The amazing thing about this thread is that no one seems to know or care to whom our debt interest is owed. Who are we paying billions and billions in usuary fees? China? Botswana? Oligarchs in Peru?

Big shell game, seems to me.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 23, 2024, 8:33 PM

|

|

Japan, China, UK, are the biggest foreign creditors. Without their investment in the US economy, we would have had several recessions in your 13 or 14 years.

|

|

|

|

|

|

Clemson Icon [27072]

TigerPulse: 100%

54

Posts: 47063

Joined: 2010

|

Central Banks, all controlled via the BIS. Bankstas always make bank.***

Aug 24, 2024, 3:57 AM

|

|

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Central Banks, all controlled via the BIS. Bankstas always make bank.***

Aug 24, 2024, 1:56 PM

|

|

The biggest single creditor is the US, to SS, medicare, pension funds, and other obligations. For many of the years we were taking in surplus FICA funds, the government didn't advertise spending that excess as part of the deficit. Then we got to a surplus under Clinton, not including those funds, and then to a real surplus. Bush gave away the surplus in checks over two giveaways, then cut taxes and ended any hope of a balanced budget again in my lifetime.

That's two times presidents have intentionally run up the debt since 2000. Most serious economic studies blame the Bush and Trump tax cuts for all of the debt and deficit issues that the poorly informed original poster complained about. They undid everything Bush I and Clinton did and then doubled down on making it worse.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Central Banks, all controlled via the BIS. Bankstas always make bank.***

Aug 25, 2024, 1:47 PM

|

|

The second biggest creditor is the federal reserve at a little over 20%. Over 40% combined is held by trust funds and the fed.

Biggest risk to the situation is another pandemic, or renewing the Trump tax cuts.

|

|

|

|

|

|

Orange Phenom [14595]

TigerPulse: 100%

49

|

Since it is apparently really bothering a poster or two here and somewhat

Aug 24, 2024, 6:04 PM

|

|

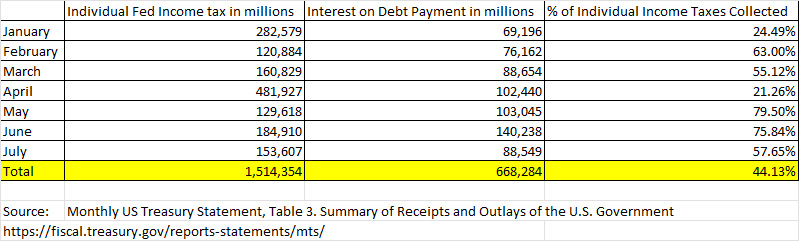

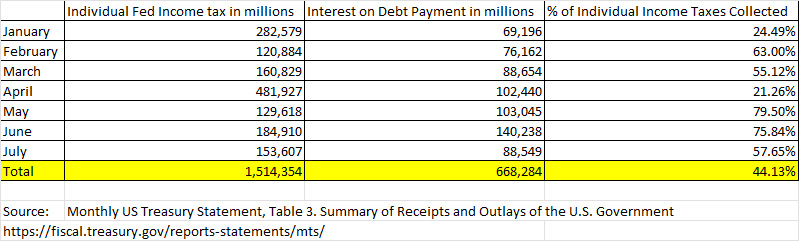

detracting from the bigger picture of our Federal Debt is going to crush us and NO ONE in the political arena or Corporate Media seems to care... I freely admit I made a mistake. I was wrong in an area of my OP as some have pointed out. So to correct that error here is my official "I got it wrong" with the following correction:

For the record - it is not, on average, $.75 out of every $1.00 of our Individual Income Tax dollars collected going towards debt interest payments. For the first 7 months of 2024 it is, on average, $.44 out of every $1.00 of individual Federal income tax collected.

My mistake was only looking at the May and June 2024 numbers from the US Treasury report (i.e. Table 3 of the Monthly Treasury Statement). In May and June 2024 - we paid 79% and 75% of individual Income tax collections towards the debt interest. From that point I made a bad assumption that was the overall average and didn't do my due diligence and check the other months.

My bad, my mistake, I f**ked up. Flog me if it makes you feel better. I would also submit that while $.44 out of every $1.00 of individual income tax collected isn't as bad as $.75 - it certainly remains within a crisis zone for having way too much Federal debt. It really doesn't change the overall point of the post and my frustration that no one in politics or media is willing to honestly address this issue or for that matter - seems to give a hot d.amn about it.

The other figures are still accurate as far as 122% GDP to debt ratio and having interest payments greater than our defense budget in 2025.

For those that want the numbers - here are the US Treasury Report numbers from Jan 2024 to Jul 2024:

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Since it is apparently really bothering a poster or two here and somewhat

Aug 25, 2024, 1:51 AM

|

|

It's still not a correct interpretation. Why only include individual income tax instead of all revenue? And why count interest the government pays itself, unless that interest was also counted as revenue (which it isn't). When all is said and done for FY24, net interest MIGHT be 12% of spending, but I'm betting lower. Gross interest will of course be higher, but we all know that's not the important number. And the percentage of revenue is higher because of the deficit. You have to look at complete FYs instead of partial.

|

|

|

|

|

|

Head Coach [911]

TigerPulse: 72%

24

|

Re: Since it is apparently really bothering a poster or two here and somewhat

Aug 25, 2024, 1:42 PM

|

|

I finally found the numbers you posted, digging into the monthly treasury statement. It's a very shady manipulation of data to try to make your point. Remind me never to buy a used car from you.

|

|

|

|

|

|

Game Changer [1974]

TigerPulse: 93%

31

|

Re: Our Federal debt is $34.5 trillion and growing

Aug 24, 2024, 9:36 PM

|

|

How about Mike Norvell for POTUS?

Do you’ll gullible Trumpers believe in him?

|

|

|

|

|

|

Replies: 52

| visibility 4096

|

|

|

to award

the award.

to award

the award.