|

Replies: 34

| visibility 1892

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

|

|

|

|

Paw Warrior [4954]

TigerPulse: 100%

37

|

Schwab Roth IRA - buy some Bitcoin ETFs***

4

Dec 10, 2024, 10:39 AM

|

|

|

|

|

|

|

|

Top TigerNet [28379]

TigerPulse: 100%

55

Posts: 10919

Joined: 2011

|

Roth IRA for sure

1

Dec 10, 2024, 11:48 AM

|

|

at least 25% in BTC exposure.

unless he's got his daddy's big balls, then you can just get him an account in River w/ some coins brah

|

|

|

|

|

|

Tiger Titan [49755]

TigerPulse: 100%

58

Posts: 32181

Joined: 2015

|

Stock markets are not high risk right now. We are about to have a very business

1

Dec 10, 2024, 10:39 AM

|

|

friendly executive branch that is going to cut a lot of red tape (for better or worse). I think overall business health in this country is about to go through the roof.

Which, with my luck, means we are about to have a recession.

|

|

|

|

|

|

TigerNet Legend [142586]

TigerPulse: 100%

67

Posts: 93479

Joined: 1998

|

It's just plain dumb to put $1000 in a retirement account

6

6

Dec 10, 2024, 10:43 AM

|

|

when he could be tripling that every week with an 'investment firm' I know about in Gastonia.

|

|

|

|

|

|

All-Time Great [96984]

TigerPulse: 100%

63

Posts: 27808

Joined: 2014

|

This is a great idea

2

Dec 10, 2024, 10:44 AM

|

|

22 years ago.

I kid. Really, to answer your question. Idk. I am lucky and my in-laws are doing this for our kids. It's a brokerage account though. We just perform O&M on the 529 for McLovin kids.

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

We done good, I think, to get him through college with no student loan debt.

2

Dec 10, 2024, 10:45 AM

|

|

Now time for the next step...

|

|

|

|

|

|

Heisman Winner [78671]

TigerPulse: 100%

62

Posts: 109899

Joined: 2003

|

I think you've got to separate the two desires.

2

Dec 10, 2024, 10:44 AM

|

|

Either give him a leg up on the retirement funds OR the big expense savings account. I guess you could go $500 and $500.

Does he have gainful employment yet and if so is it really good. As in could he max out the 401k match and still have some to put into an IRA? If so I'd certainly help them start one of those with some higher risk funds. If not, maybe just the high yield account would be better for now.

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

Yes, he's gainfully employed and already has some savings. He should be hired

2

Dec 10, 2024, 10:48 AM

|

|

as a full time employee with 401K etc pretty much as soon as he graduates, so he'd start doing their retirement to the max as soon as it was available. This would be extra.

|

|

|

|

|

|

Tiger Titan [49755]

TigerPulse: 100%

58

Posts: 32181

Joined: 2015

|

You need another son?

1

Dec 10, 2024, 10:51 AM

|

|

My father's statement when I was going through college was "Why college? Come work at the plant with me. By the way, I don't have the money to pay for this. Go get a job... at the plant with me"

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

Re: You need another son?

1

Dec 10, 2024, 10:53 AM

|

|

|

|

|

|

|

|

Heisman Winner [78671]

TigerPulse: 100%

62

Posts: 109899

Joined: 2003

|

|

|

|

|

|

Heisman Winner [83848]

TigerPulse: 100%

62

Posts: 26172

Joined: 2012

|

High yield savings account allows you to take money out fast and without

2

Dec 10, 2024, 10:46 AM

|

|

penalty. It's a pretty good option if you need liquidity in a hurry, but still want to earn a small amount.

|

|

|

|

|

|

Heisman Winner [78671]

TigerPulse: 100%

62

Posts: 109899

Joined: 2003

|

Oh, another thought. If you can find an add on CD that will allow it to grow

1

Dec 10, 2024, 10:49 AM

|

|

somewhat and not be as easy to get out as a savings account.

|

|

|

|

|

|

Tiger Titan [49755]

TigerPulse: 100%

58

Posts: 32181

Joined: 2015

|

Aren't CD's at like 2% right now?***

1

Dec 10, 2024, 10:52 AM

|

|

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

4 to 4.75 at our credit union, but 5K minimum.***

Dec 10, 2024, 10:56 AM

|

|

|

|

|

|

|

|

Tiger Titan [46471]

TigerPulse: 100%

58

Posts: 41891

Joined: 1998

|

Get em lots of that Hawk Tuah coin.***

3

Dec 10, 2024, 10:50 AM

|

|

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

Re: Get em lots of that Hawk Tuah coin.***

2

Dec 10, 2024, 10:51 AM

|

|

|

|

|

|

|

|

TigerNet Legend [142586]

TigerPulse: 100%

67

Posts: 93479

Joined: 1998

|

My opinion...

3

Dec 10, 2024, 10:54 AM

|

|

Forget the coin part and just get him lots of that Hawk Tuah.

|

|

|

|

|

|

Tiger Titan [49755]

TigerPulse: 100%

58

Posts: 32181

Joined: 2015

|

The more coins he gets the more hawk tua he gets

2

Dec 10, 2024, 10:54 AM

|

|

|

|

|

|

|

|

Ultimate Tiger [36078]

TigerPulse: 100%

56

Posts: 19545

Joined: 2022

|

We have an investment UTMA for our 5yo that we fund $100/m

4

Dec 10, 2024, 11:09 AM

|

|

We also have a traditional savings account where we do the same. We opted for this route instead of a 529 because it has more flexibility down the road.

The plan is to surprise him after he graduates. Kid already has more money to his name than many adults.

|

|

|

|

|

|

Rival Killer [3096]

TigerPulse: 100%

33

|

FYI on 529. Recipient can roll over to Roth IRA once 529 is 15 yrs or older.

2

Dec 10, 2024, 11:28 AM

|

|

So, I would not completely ditch the 529 if you're financially able to fund multiple options.

Contribute some to 529, some to UTMA brokerage account or even a high yield savings account. This gives a lot of flexibility when kid gets to college age.

|

|

|

|

|

|

Hall of Famer [8953]

TigerPulse: 100%

43

|

|

|

|

|

|

Ultimate Tiger [36078]

TigerPulse: 100%

56

Posts: 19545

Joined: 2022

|

Or, you know...

3

Dec 10, 2024, 12:15 PM

|

|

have wealthy friends.

|

|

|

|

|

|

Ultimate Clemson Legend [103345]

TigerPulse: 100%

64

Posts: 67878

Joined: 2002

|

Here's what wife and I did. I don't do financial advice. So fwiw....

2

Dec 10, 2024, 11:21 AM

|

|

When we graduated from college, we both got jobs and all that good stuff. I set up an IRA, she set up a 401k. But those first few years we set aside a regular savings account (quick/emergency access) then a short-term CD. Into those emergency accounts we poured our money the first 2 years, until we had a good 8 months of emergency savings to access, then switched to pouring most into the IRA/401K's.

As time went on we obviously raised the emergency account to match expenses, while pouring everything else into the other accounts like the 401K and retirement. But I wouldn't think one of those bank CD's or savings accounts would be good for retirement, but they're good for accessible savings. I'd build that up first, as at his age, if he gets a decent job, and keeps expenses low, he can spend a year or so building emergency savings, without harming his long-term retirement savings.

We basically saved first for emergencies, and then even more for retirement. Too many people our age today have massive 401K and retirement savings, but can't afford a $20K medical bill. I think that 1-2 years of concentrating on emergency savings actually helped us budget and ultimately allow more retirement to build. At his age, some emergency savings should be a priority, and hopefully in just a year or two he can really start building the retirement part.

Saving is important, but you have to do it both ways. Don't end up in a bad spot being retirement rich and life events/unexpected events poor.

PS. Wife and I both had CD's from our grandparents we cashed out to put a down payment on our first house. So we were motivated to replenish that before diving into retirement saving. Best tip, live poor for at least 5 years. Even as your income grows, keep those expenses down, early on. It will pay dividends later on.

|

|

|

|

|

|

Hall of Famer [8953]

TigerPulse: 100%

43

|

I agree with others that you seem to have two different goals here.

3

Dec 10, 2024, 11:26 AM

|

|

How sophisticated is he, financially? (No judgment, my parents know nothing about money and taught me almost nothing about money. BTW, Clemson used to have some fantastic programs on financial literacy. They literally changed my life.)

For car/house savings, look into an Ally high interest savings account. You can set up various "buckets" in the account to track saving and savings goals. That might be especially useful to someone starting out. For something more aggressive, or even retirement focused, look into a simple Vanguard brokerage account.

Whichever you choose, I would set up a monthly autodraft (from his accounts). Even if it is $100 it will make a big difference over time.

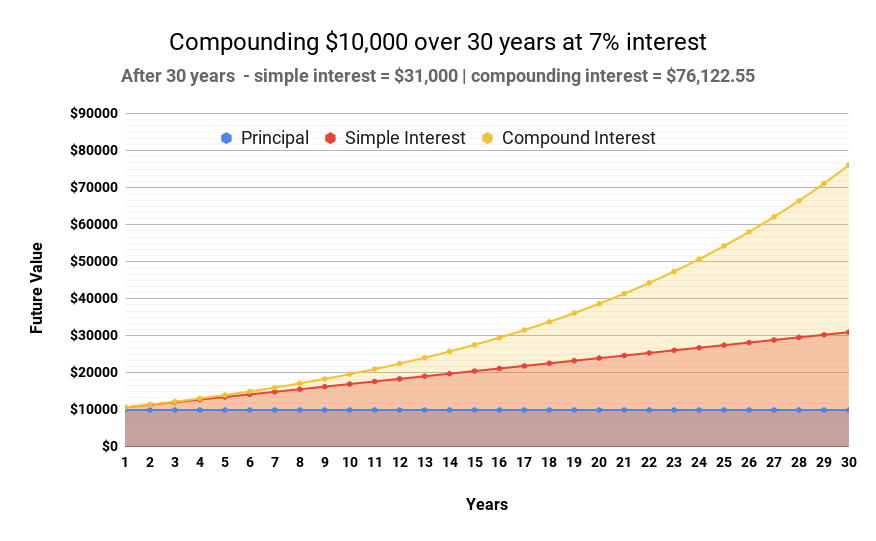

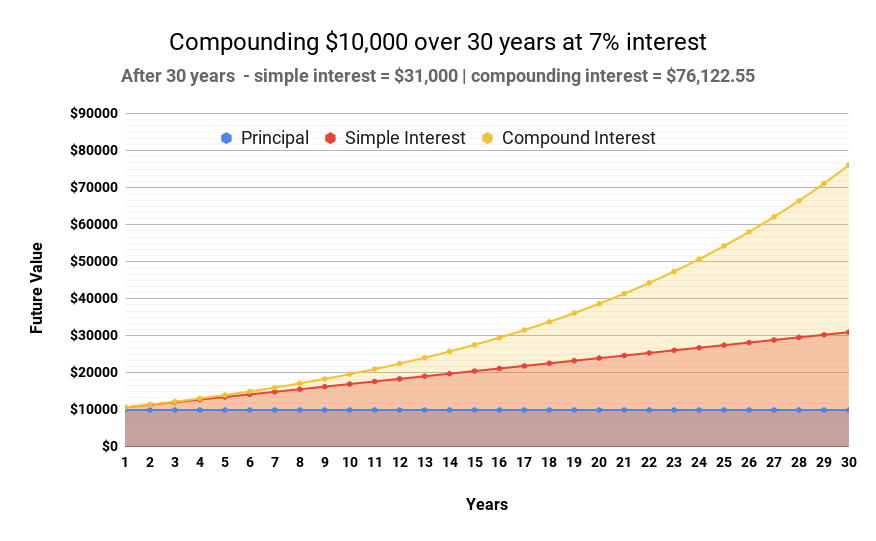

Most importantly, print out this chart and put it over the Sydney Sweeny poster hanging by his bed. Compound interest, baby.

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

He's not particularly sophisticated financially. He's good about being frugal

1

Dec 10, 2024, 11:41 AM

|

|

and stretching the money he has, and we have talked about savings and long term stuff generally. But he's never really had any real money and hasn't been involved with our financial decisions.

It does seem like maybe we should look at two accounts instead of one (retirement + high yield savings).

|

|

|

|

|

|

Top TigerNet [28379]

TigerPulse: 100%

55

Posts: 10919

Joined: 2011

|

|

|

|

|

|

Heisman Winner [81033]

TigerPulse: 100%

62

Posts: 63927

Joined: 2005

|

Deposite $1k into Mybookie account

6

6

Dec 10, 2024, 12:14 PM

|

|

Bet everything on Texas to cover the spread. PROFIT

|

|

|

|

|

|

Clemson Sports Icon [56930]

TigerPulse: 100%

59

Posts: 13596

Joined: 2018

|

Re: Deposite $1k into Mybookie account

5

5

Dec 10, 2024, 12:16 PM

|

|

|

|

|

|

|

|

Game Day Hero [4237]

TigerPulse: 100%

36

|

Remember,

5

5

Dec 10, 2024, 12:30 PM

[ in reply to Deposite $1k into Mybookie account ] |

|

Wes Goodwin has extra time to scheme against Sark. RIP SARK.

WAIT

SARK also has extra time to scheme against Goodwin. FUUUCCCKKK.

|

|

|

|

|

|

Top TigerNet [28917]

TigerPulse: 100%

55

Posts: 22149

Joined: 2002

|

Buy him some BitCoins ... put them in a protective sleeve so they don't get

1

Dec 10, 2024, 12:19 PM

|

|

scratched up.

|

|

|

|

|

|

National Champion [7227]

TigerPulse: 100%

42

|

Re: Buy him some BitCoins ... put them in a protective sleeve so they don't get

Dec 10, 2024, 7:04 PM

|

|

Buy him some scratchers...may win enough for (2) 12-packs and a tank of gas.

|

|

|

|

|

|

Game Day Hero [4237]

TigerPulse: 100%

36

|

I'd go with a vanguard account, maybe put money in VTSAX

1

Dec 10, 2024, 12:26 PM

|

|

And get him the Bogleheads books on retirement and the three fund portfolio. Two easy books that each take about an afternoon to read. It's counter to what he'll see with all the market gambling going on now (wallstreet bets, crypto), and the boglehead approach is a more sure thing in the market.

Educating the kids on investing and compound interest versus picking the right fund now is what's important. A big market index fund like VTSAX is a proven investment and gold place to park seed money for the kid. He can keep an eye on it, watch it make and lose money, and learn that the market is risky.

|

|

|

|

|

|

Orange Immortal [62086]

TigerPulse: 100%

60

Posts: 43277

Joined: 1998

|

Re: Lunge money nerds: GITT with your suggestions for an account for a youngin.

3

Dec 10, 2024, 12:48 PM

|

|

|

|

|

|

|

|

Replies: 34

| visibility 1892

|

|

|

to award

the award.

to award

the award.