|

Replies: 46

| visibility 351

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

CPI came in hotter than expected.

Apr 10, 2024, 9:17 AM

|

|

Meaning the consensus widely predicted Fed rate cut for March, pushed back to April, pushed back to May, pushed back to June....... Will now happen in July or August.

The six fed drops widely predicted this year had dropped to 5. To 4. To 3. May drop to 2 now.

At some point, something gives. The fed is playing chess and the markets are playing checkers.

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

less than two

Apr 10, 2024, 9:34 AM

|

|

bonds up, markets down

with the Fed economy we go

round and round

|

|

|

|

|

|

Oculus Spirit [75780]

TigerPulse: 100%

Posts: 108890

Joined: 10/26/03

|

This is a wonderful and totally flawless system we work with here.***

Apr 10, 2024, 9:36 AM

|

|

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

Re: This is a wonderful and totally flawless system we work with here.***

Apr 10, 2024, 9:41 AM

|

|

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

shut up boys

Apr 10, 2024, 9:42 AM

|

|

5 days, get your checks in the mail!

now get back to work

|

|

|

|

|

|

Oculus Spirit [75780]

TigerPulse: 100%

Posts: 108890

Joined: 10/26/03

|

Somebody around here said that they economist said too

1

Apr 10, 2024, 9:55 AM

|

|

many are at work and that is the problem. Other people out and about in the worlds say nobody wants to work anymore. Which is it?

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

somebody's economist said that?

Apr 10, 2024, 10:15 AM

|

|

or the economist magazine said that?

define the "problem"...is it wage growth, GDP growth, debt, inflation, ... ?

you aero'd TF outta this one bro

|

|

|

|

|

|

Oculus Spirit [75780]

TigerPulse: 100%

Posts: 108890

Joined: 10/26/03

|

just economist in general say that unemployment has to be

Apr 10, 2024, 10:24 AM

|

|

at x and is currently too low. That will be forever stupid to me and anyone that thinks a good system should work that way should 100% quit their job and stay quit until we get abo

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

The unemployment number is a joke.

1

Apr 10, 2024, 10:37 AM

|

|

I honestly can't understand why it's so widely regarded as some essential economic metric to use. The unemployment number is the current percentage of workers in the US who are 1) NOT EMPLOYED..... AND..... 2) LOOKING for a job.

That's IT.

Officially, according to the BLS and every politician running for reelection, and every talking head economist on TV, if you're a healthy American between 16 and 65 and are NOT working, and are NOT looking for a job actively, you are NOT unemployed. You simply don't exist. You're not in the universe of the data used to calculate "unemployment".

This is why you can go over to the labor participation rate to see the real problem. The percentage of ALL working-aged Americans (16-65) who are employed, has not been this low since the 1970's. Almost 40% of Americans (37%ish), who are working-age, are not working. How does that translate to 3.8% unemployment? It DOESN'T.

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

another facet that I overlooked haha

1

Apr 10, 2024, 10:53 AM

|

|

yeah, all the labor numbers are cooked to hell and back.

nuked like one of McLovin's steaks.

everything the BLS puts out is propaganda and complete hogwash.

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

i love you man

1

Apr 10, 2024, 10:51 AM

[ in reply to just economist in general say that unemployment has to be ] |

|

but I'm having a hard time tracking your question.

I think your question is, why is there a problem with having TOO LOW of unemployment?

And specifically you're referring to 'economists' stating this is problematic?

If this understanding is incorrect, then I just wasted a fair amount of time typing up a buncha BS

If that is correct, I'll take an uneducated neanderthal swing at it...

For starters, economics is theory based on various modeling techniques. Those modeling techniques include inputs that drive outputs that allow 'economists' to derive theories on what drives price action, monetary flow, etc. etc. etc. (sidebar: hands down my favorite set of classes at Tech was game theory, and I do zero with it).

Another point to clarify, is that most 'economists' are trained in what we could call a basic school, and/or a set of principles that guide them in their theoretical discussions, theses, etc. Like, for example, why Paul Johnson doesn't run a spread, sling-it-around offense. And Dabo doesn't use the Portal.

When you mix those two together, you get economists that pigeon hole themselves into looking for specific set of outputs, based on their most-primitive understanding / guiding principles of how the economy functions and can be modeled.

Why am I saying this?

Well, odds are, the 'economists' saying this that you're reading (no offense), or that the majority of Americans are reading are deep-rooted Keynesians (with slight spin-offs) or, even worse, are deep into the status quo of current US / Western MMT.

So what that means is, they look for 2 parameters to judge the economy, because it's their 2 mandates:

1: Inflation

2: Unemployment

They've theorized (and set policy as such) that 2% inflation and (I think) ~4% Unemployment(? need to double check, maybe 4.5%) is the "sweet spot" for our modern economy to function at an equilibrium of sorts.

Anything under 4% can lead to wage inflation, which as we've discussed in the past, will set off broader, less-controllable inflationary pressures across the economy. Anything higher than 4%, is obviously meaning people are out work (technically, so is 4%, I get that), and burdens the state (because for some reason these jackoffs think the state needs to pay for people who don't have a job).

Also understand you're never going to have 0% unemployment. Ever. Too much job turnover, seasonality, people moving, having kids, getting hurt.....you name it. But there comes a 'breaking point' (according to these Ivy League bean counters) where a too-low of a % of unemployed becomes unsustainable and begins affecting price action that can ripple through all sectors of the market and affect the money supply.

Take for example...boom towns. IIRC, I think there's a town in North Dakota that was an O&G boom town right? Maybe like 20 years ago ish? Where unemployment was probably 0 or #### close to it, and you had guys making $80-120/hr working on an oil rig. Maybe more, idk. All that's fine and dandy, right?

Eh, maybe not. The bartenders who serve those guys then need to make stacks or they'll go work on the rig. That drives up the prices of beer. The hair dressers can charge 1.5-3.5x for hair cut b/c they know the guys are there and they have the money. The housing, obviously, catapults to unsustainable cost levels, b/c there's money everywhere. Everything goes up.

Now, amplify that to a $21ishT economy, and the same logic / modeling could apply.

Not to put words in their mouth, but I'd assume that's their explanation.

In case this has not become obvious over the years. I vehemently oppose this method of economical thought and governance, so in short (HA! - really ####### long I guess at this point), I agree with you.

At the end of the day, if the market set the rate for the cost of capital, and it wasn't artificially controlled by a group of bankers looking at these metrics, then also theoretically, the unemployment and/or inflation % would also be more market driven, as the velocity of capital becomes more organic.

If you were able to remove State control of money supply, and State support of the unemployed, you remove the issue of unemployment entirely as people and markets are then left to determine their own economic outputs...plus, you know, you'd save a hefty amount come each April.

|

|

|

|

|

|

Oculus Spirit [75780]

TigerPulse: 100%

Posts: 108890

Joined: 10/26/03

|

I think we are mostly on the same page here and agree the system sucks.

Apr 10, 2024, 11:04 AM

|

|

Here is what I know. Powell has said as much as the employment rate is too high. If anyone believes this yet it still taking a paycheck, then they are a first rate piece of trash and maybe need to have some unconstitutional stuff done to them.

I think that about covers this topic. While I don't claim to know better solutions, I just know that a rich old white man making decisions that he thinks will put poor people out of work first is wrong.

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

That's how the Fed looks at it because they only have so many tools.

Apr 10, 2024, 11:38 AM

[ in reply to i love you man ] |

|

The only thing they can do to reign in inflation is raise interest rates, which puts the hurt on the economy, which results in higher unemployment rates and less consumer spending. They can use those measurements to determine their level of success or failure. It seems odd to root for unemployment, but it's their only shot.

Economists in general look at way more factors than just those to make assessments about the economy.

|

|

|

|

|

|

Oculus Spirit [75780]

TigerPulse: 100%

Posts: 108890

Joined: 10/26/03

|

It would not be the Federal Reserve's job, but the real way to

1

Apr 10, 2024, 12:23 PM

|

|

fight inflation is to have big time antitrust laws with teeth and anything else one can think of to inspire competition rather than allow it to be stifled. Give folks 10 choices on where to get stuff and CEOs can't simply raise prices on stuff.

For me, all of this stuff comes down to the wrong people feel the most pain during hard times, but the wrong people control everything so what can you do?

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

I hear you

Apr 10, 2024, 12:29 PM

|

|

but the amound of m&a and consolidation that's occurred over the past 3 or 4 decades is not possible without Fed monetary policy over that same time period.

so the Fed enabled it, government allowed it. remove both and it solves itself.

|

|

|

|

|

|

Oculus Spirit [75780]

TigerPulse: 100%

Posts: 108890

Joined: 10/26/03

|

Fine by me. Eliminate them all, but probably not in a

Apr 10, 2024, 12:40 PM

|

|

project 2025 kinda way.

|

|

|

|

|

|

All-In [26707]

TigerPulse: 100%

Posts: 15958

Joined: 4/12/07

|

JFC YOU TIGGITY WANNABE MOFUGGA

Apr 10, 2024, 8:04 PM

[ in reply to i love you man ] |

|

Cliff notes man, not Cliff Clavin.

|

|

|

|

|

|

Oculus Spirit [79448]

TigerPulse: 100%

Posts: 63279

Joined: 10/30/05

|

|

|

|

|

|

Hall of Famer [24171]

TigerPulse: 100%

Posts: 12280

Joined: 9/1/14

|

Re: CPI came in hotter than expected.

Apr 10, 2024, 9:47 AM

|

|

They need to raise pause raise pause until they get to 8. They don't have the stomach for the necessary.

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

They can't. Not a stomach issue, it's a suicide issue.

3

Apr 10, 2024, 10:06 AM

|

|

If they raise rates 8-10%, then the solvency of the US government comes into serious question. It already has been for years IMO, but at 10% fed lending rates, the wheels come off. And I agree, they never raised rates high enough to counter the inflation we had. And as a result, there was no pain, this "soft landing" we hear about, it isn't a landing at all. What a soft landing does is bake in the inflation we already had.

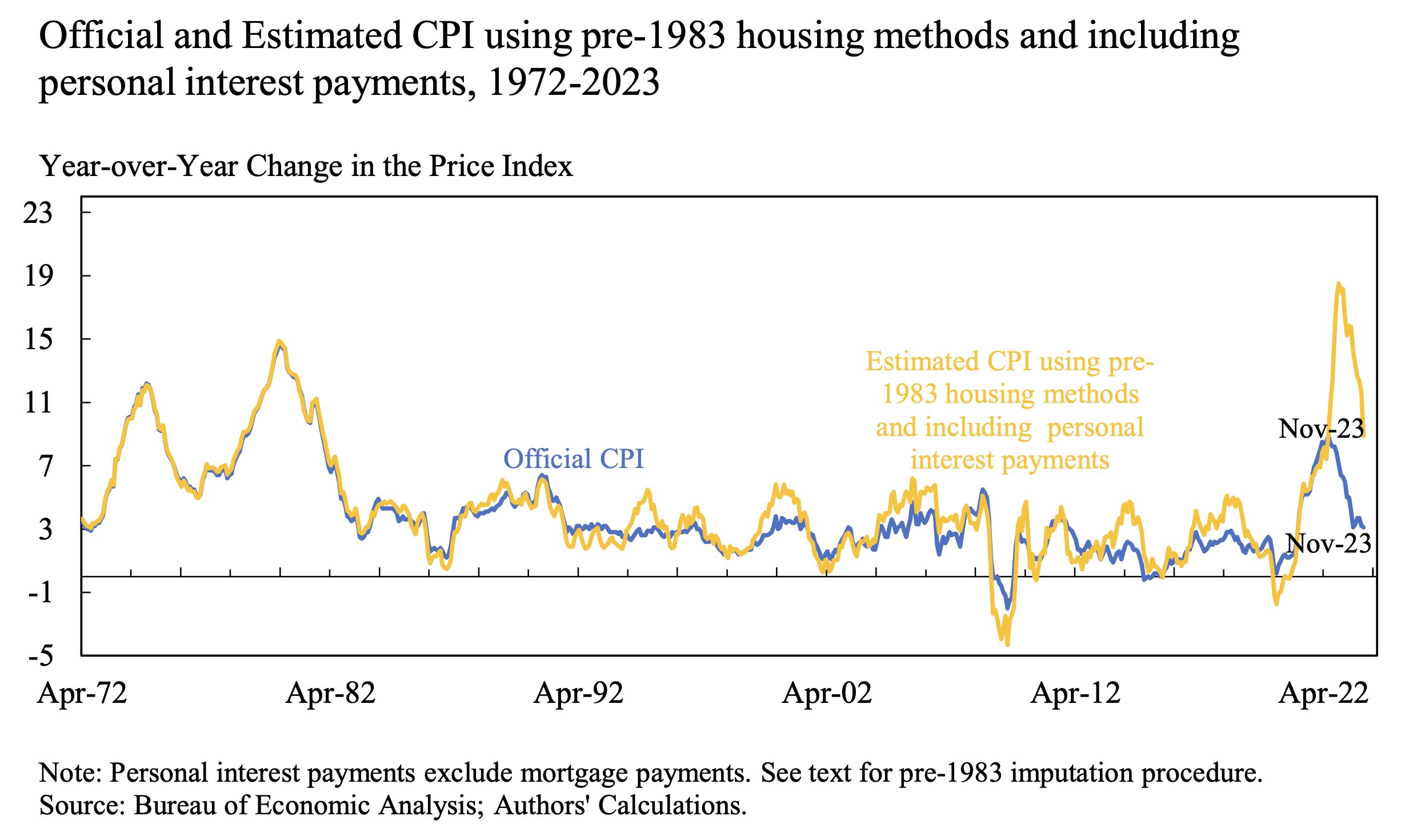

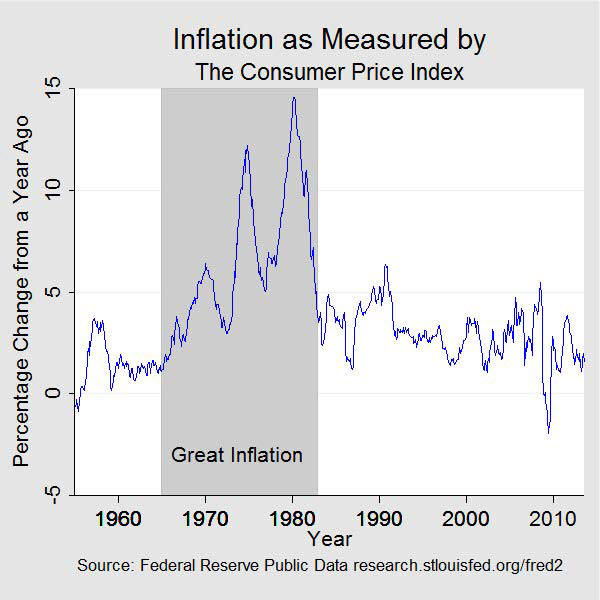

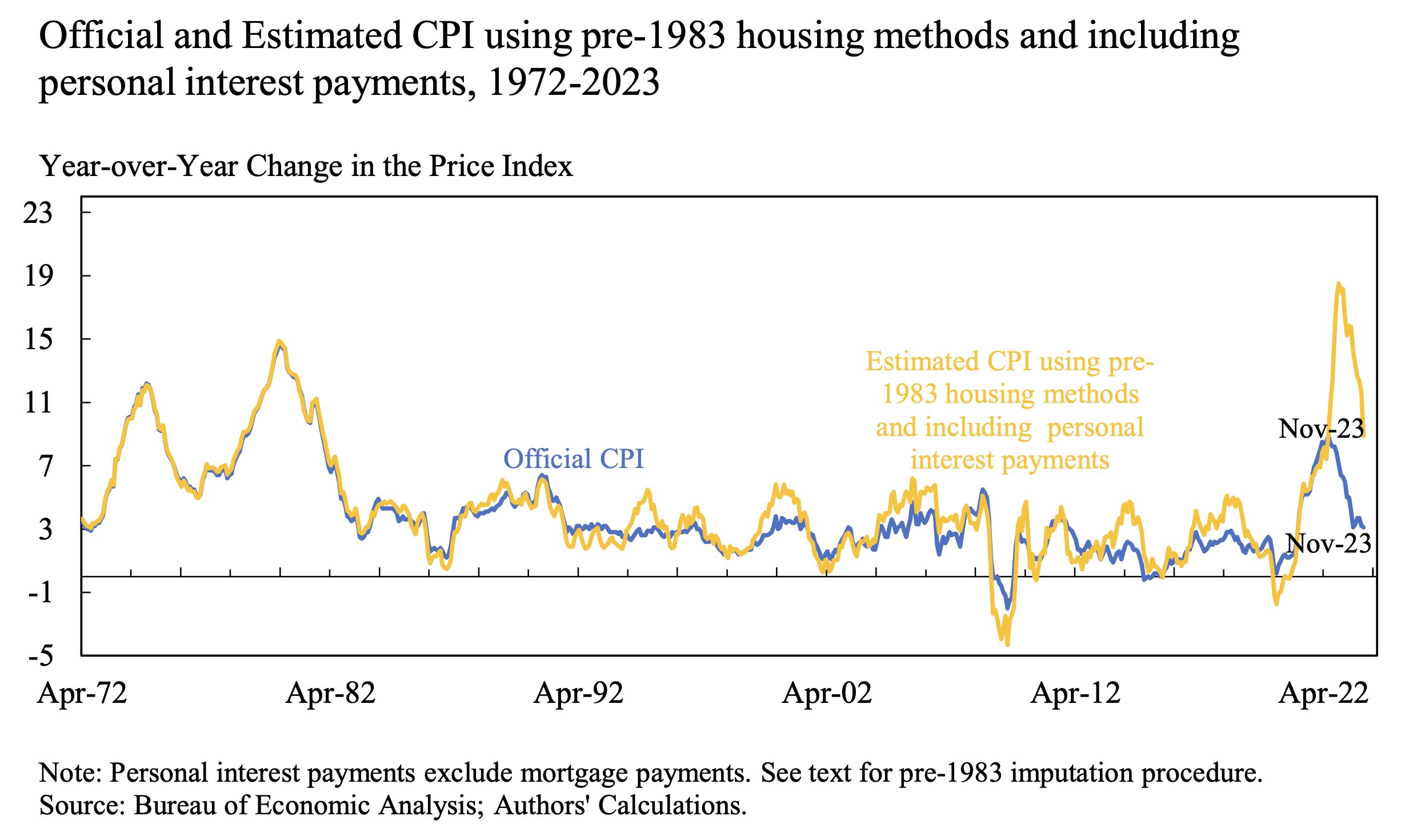

We've been through this before in the early 80's. We had massive inflation under Carter, and the early Reagan years, and Volcker raised rates to the moon to stop it. ALSO, they changed the way they calculate CPI in 1983. That helped drop inflation as well, at least in the BS data department. HOWEVER, if you calculate inflation based on the pre-1983 BLS formula, the inflation we just went through was every bit as severe as the early 80's. The response, though, has been nothing near the response back then. What's worse, is we can never raise the fed rate to 8%, 10%, 12% or higher like they did in the 80's. That would cause a financial crisis that would make the housing crisis look tame. Not to mention render the US Federal Government insolvent.

So we just trudge along. Best case, if well managed, is we get a long period of stagflation. We are currently on the trajectory Japan was on in the 1990's when their economy went through a slow motion collapse. And every month or two we add another trillion to our national debt, and every year for the foreseeable future, we will spend more than $1T just paying the minimum balance on our national debt. And that will just be paid with more debt, compounding the problem.

Either we have a financial crisis and prices drop, or wages rise to meet new inflation, or consumers stop spending, OR we get a glut of supply.

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

don't think I've agreed with a post more

1

Apr 10, 2024, 10:14 AM

|

|

only correction, we're adding $1T every 100 days, and that's likely to shorten as debt payments rise as a % of gov outlays

favor to ask (srs): can you please share a source for a comparison of CPI calcs using pre-83 methodology versus today if you have it handy? I've seen that chart a few times and have been wanting to share it, but I can't find it again.

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

Here you go.

2

Apr 10, 2024, 10:23 AM

|

|

And THIS IS WHY I think having the BLS calculate inflation data is an absolute farce. When you hand-pick what to use to calculate inflation, and purposefully exclude anything and everything that's volatile, you normalize the inflation numbers, preventing any extreme numbers from appearing in the data.

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

More info.

1

Apr 10, 2024, 10:45 AM

[ in reply to don't think I've agreed with a post more ] |

|

It's not as simple as "they're cooking the books." The fact is, the world is complicated and it's difficult to represent enormous economic trends with tidy little numbers.

Why Has the Inflation Calculation Changed Over Time?

As prices soar, some critics are raising doubts about the official inflation figures. But many economists say the figures are an accurate snapshot of rising prices.

May 24, 2022

Consumer prices are increasing at the fastest clip in about 40 years, climbing 8.3 percent in April compared with a year earlier.

Here are two major changes made to inflation since the 1980s and why economists adopted them.

Change No. 1: Inflation doesn’t include house prices

People who are skeptical about America’s inflation measures often cite a change to how home costs are measured in the Consumer Price Index, a closely watched metric produced by the Bureau of Labor Statistics.

In 1983, the government switched from using home prices — which also included mortgage payments and maintenance costs — to using rental prices to gauge the cost of housing.

The cost of housing for people who own their property is now measured using what is called “owners’ equivalent rent”: how much their house would cost to rent if they did not own it.

The idea is that homes are an investment. House prices appreciate, and you may eventually sell for a profit a property that you have purchased. Rent, however, represents consumption. It does not leave you with an asset that you can sell down the road.

Critics often argue that by leaving home prices out of the equation, the inflation metric underestimates the cost of living at moments when home prices are increasing markedly and when it costs first-time buyers more to get a foothold in the market. Some even claim that if the government used the old methodology, its reported inflation rate would be much higher today than it was during the 1980s.

It is true that inflation isn’t perfectly comparable over time because of the change in how housing was measured, said Omair Sharif, founder of the research firm Inflation Insights. But the change would not be enough to make today’s inflation higher than the nearly 15 percent it hit 40 years ago.

“Yes, inflation today would be higher, but by roughly 1.25 percentage points, not the 4 to 5 percentage points people say,” said Mr. Sharif, who last year pulled home price, mortgage costs and home repair data from the 1970s, applied the relevant weights, and did the math on the old numbers to see how much the change in methodology changed inflation.

“It wasn’t a mind-blowing number like a lot of people think it is,” he said.

Another estimate — using calculations used in a paper for The Quarterly Journal of Economics and updated for the newsletter Full Stack Economics — found that including home prices and interest rates instead of rent would have pushed the inflation rate to 11.5 percent in February, the latest date available, up 3.6 percentage points from the official figure that month. That’s more than Mr. Sharif’s estimate but still less than the 1980s.

Others argue that the C.P.I.’s rent measure understates the cost of other types of shelter, pointing out that real-time rent trackers tend to capture rising prices much more quickly. But that is for a simple reason: They track new rents, while the C.P.I. tracks a sample of existing rents, including for people who renew their leases.

“This divergence means that at the moment, the C.P.I. does not do a good job telling the story of how costly it is for an individual or household to secure housing in a new city,” said Jeff Tucker, a senior economist at the real estate website Zillow. Yet the point is to better reflect what prices look like for all consumers, not just ones looking for a new home, he said.

Change No. 2: Economists swap expensive products for cheaper ones

Economists once collected a basket of items — like eggs, milk, shampoo and other items — and simply tracked how much they cost over time, updating the basket only rarely. But that measure was criticized for potentially overestimating inflation because it ignored that consumers adjust their spending both over time and as prices increase.

Economists began to update the basket more regularly about 20 years ago, and the weights are now reset every two years to reflect what people actually spend their money on.

They also tried to account for substitutions. Imagine that the price of cupcakes went up one month. Instead of paying more, a consumer might buy cookies instead — a decent but cheaper dessert alternative — and their monthly costs wouldn’t go up.

They might also buy a container with fewer cupcakes, switch to a cheaper brand or shop at a discount store where cupcakes are cheaper. To factor in that behavior, the government tweaked how it calculates inflation in some categories in 1999, correcting the problem in the eyes of many economists.

Critics sometimes raise a separate point: that product swaps are made between entirely different categories, like using chicken when the price of steak increases. Those larger substitutions are not included in the normal C.P.I. calculation, but are included for a measure called the Chained Consumer Price Index. While the C.P.I. showed prices rose 8.3 percent in April from a year earlier, the Chained C.P.I. was a little more muted, at just 7.8 percent.

Think those changes aren’t enough? There will certainly be more. The Labor Department is still constantly instituting changes to try to make C.P.I. a more accurate reflection of reality.

“It’s a good long-run method,” Mr. Detmeister at UBS said. “Over the course of a couple of months, even over the course of a year, it may differ from what is happening on the ground.”

https://www.nytimes.com/2022/05/24/technology/inflation-measure-cpi-accuracy.html#:~:text=In%201983%2C%20the%20inflation%20calculation,making%20the%20measurement%20less%20volatile.&text=The%20idea%20is%20that%20homes,property%20that%20you%20have%20purchased.

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

Lol.

1

Apr 10, 2024, 10:59 AM

|

|

This is cooking the books, plain and simple.

I misplaced my reply earlier. Renting is now cheaper in most places than buying. That's a change. Why? Because most landlords are locked into low sub 4% mortgages from 2022. Anyone building a rental unit today and financing at current rates, will charge a premium, and existing landlords with low mortgages are making massive profits.

Let me put it another way. I could rent my house for $3.5k a month right now, and that leaves a huge margin that would cover insurance, taxes, maintenance, and my mortgage payment. NOW, if I sold my house, and purchased it again, for the exact same current market price I sold it, took all of my equity and used it as a down payment, and financed the rest, my monthly mortgage payment would be north of $4K, and I'd be losing money renting it for only $3.5K.

Using rent as the metric/data NORMALIZES the data. And that was what was intended in 1983.

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

You're acting like interest rates only affect mortgages for rental properties.

2

Apr 10, 2024, 11:18 AM

|

|

"Renting is now cheaper in most places than buying. Anyone building a rental unit today and financing at current rates, will charge a premium, and existing landlords with low mortgages are making massive profits."

And that makes renting cheaper than buying how? The Fed raised interest rates in large part to drive down demand for homebuying and thus reducing home prices. In what way does that play into the master plan of concealing real inflation rates?

It's easy to pretend everything is a scam or a conspiracy or it's rigged. The truth is always a lot thornier.

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

Renting is cheaper now than buying because the overhead on an existing

Apr 10, 2024, 12:07 PM

|

|

rental financed at less than 4% (most around today), will be cheaper than the rent a landlord who just bought a new rental or built a new one at current financing rates would/could charge. It's also cheaper than a new home purchased at current market value and current rates.

Housing prices will not drop from higher rates because 80% of current home mortgages are locked into long-term mortgages at rates below 4%. And I'm one of those people. And if you were to pay me to buy my house, today, I'd want/NEED about $170K ABOVE what Zillow says my home is worth, just to make a lateral move, or buy the same house back even.

THIS is why house values will not decline with the new rates. And a premium above an already inflated market would have to be paid for people like me to move without downsizing or maying significantly more than previously on a new mortgage. Hence values have not dropped, and won't any time soon. It will take a long time for this problem to fix itself, more than a decade.

As more and more principal is paid, over time, the premium a buyer would need to pay will decline, and the only people today who can easily sell their homes are those who own their home fully, or are very close to paying off their financing. hence it will be a slow process. Builders have noticed this too and are building smaller new houses.

And no interest rates are also keeping me from buying a truck for my oldest son.

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

You're using anecdotal evidence and made-up numbers.

Apr 10, 2024, 12:43 PM

|

|

"80% of current home mortgages are locked into long-term mortgages at rates below 4%."

Source please.

Here are some numbers from October 2021 (the peak was Q4 2020):

As of the end of July, only 19 percent of those with a pre-pandemic mortgage had refinanced since the start of the Covid-19 outbreak. Meanwhile, nearly half (47 percent) had not even considered refinancing. Of those who had not refinanced, nearly one quarter (23%) said it was because they thought it was too much paperwork/hassle.

While the savviest homeowners already refinanced — and some have even done so twice — millions more have yet to take advantage of mortgage rates that once would have seemed unthinkably low. Among homeowners with a mortgage they’ve had since before the pandemic, 74 percent have not refinanced, according to the survey.

Here are some more numbers:

Older vintage mortgages—those originated before 2010—were the least likely to refinance. In fact, under 9 percent of the mortgages that had been originated before 2010 that were still in repayment in 2020 were refinanced. About 17 percent of mortgages that had been originated between 2010 and 2014 were refinanced. By contrast, nearly a third of mortgages from 2015 and later vintages were refinanced during the quarters in question.

So, not 80%.

Regardless, the main reason you're not moving is because you have no incentive. Here's some anecdotal information: My parents moved us from NJ to CO in (conveniently enough for this conversation) 1983. It wasn't because of the interest rates or what the new house cost compared to the old one. My dad got a job in Denver because he wanted to live out there, so we moved. My grandparents sold their house in 1982 to move into a retirement community. Amazingly enough, people were buying and selling houses even when interest rates and inflation were high.

Also, people who financed at 4% aren't going to discount their rental pricing. If another landlord is renting an equivalent property for a higher price because of the higher interest rate, then that's what everyone will charge. Otherwise, they're leaving money on the table for no reason.

Sources:

https://www.bankrate.com/mortgages/mortgage-rate-refinancing-survey-august-2021/#:~:text=Many%20American%20homeowners%20are%20passing%20up%20a%20prime,refinanced%20since%20the%20start%20of%20the%20Covid-19%20outbreak.

https://libertystreeteconomics.newyorkfed.org/2023/05/the-great-pandemic-mortgage-refinance-boom/

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

6 is different than <4.

1

Apr 10, 2024, 3:31 PM

|

|

I had a 5% interest rate in 2009.

|

|

|

|

|

|

Oculus Spirit [81130]

TigerPulse: 100%

Posts: 56208

Joined: 9/13/04

|

Its not that big of a change, at least since about '97.

Apr 10, 2024, 5:37 PM

[ in reply to Lol. ] |

|

I can no longer afford to rent on IOP, but from about 1997-2022 it was always cheaper to rent than buy there.

|

|

|

|

|

|

Hall of Famer [24171]

TigerPulse: 100%

Posts: 12280

Joined: 9/1/14

|

Re: They can't. Not a stomach issue, it's a suicide issue.

Apr 10, 2024, 10:36 AM

[ in reply to They can't. Not a stomach issue, it's a suicide issue. ] |

|

I wouldn't be a solvency issue (unless Congress makes it one), but we are far from the fiscal restraint needed for a tight monetary policy.

|

|

|

|

|

|

Commissioner [965]

TigerPulse: 99%

Posts: 786

Joined: 10/24/18

|

Re: CPI came in hotter than expected.

1

Apr 10, 2024, 10:17 AM

|

|

Shelter cost is killing it. I just don't know how a young person affords housing or rent now.

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

Renting is cheaper than buying currently. That's because many/most

Apr 10, 2024, 10:52 AM

|

|

landlords are locked into low sub 4% mortgages on their properties. This allows them to rent cheaper than anyone could buy the same property now at current rates.

I could rent my own house for $3,000 a month currently, and make a very good profit based on my fixed LOW mortgage payment. If I sold my house, I couldn't afford to rebuy it, as my mortgage payment would be north of $3K.

This is why you had the flurry of "institutional" investors buying houses left and right in 2022. Like everyone else refinancing, they JUMPED at the chance to buy properties with sub 4% mortgage rates, knowing the return renting would be high in the future.

And new rentals being built are charging a premium which those with existing low mortgage rates are using to MAKE BANK.

|

|

|

|

|

|

Oculus Spirit [81130]

TigerPulse: 100%

Posts: 56208

Joined: 9/13/04

|

Institutional investors LEFT the market? Where?

Apr 10, 2024, 5:41 PM

|

|

I got an ad in my mailbox 2 weeks ago for Open Door to buy my house.

|

|

|

|

|

|

All-In [34641]

TigerPulse: 100%

Posts: 41446

Joined: 4/20/01

|

Inflation is transitory. Pewtin is causing transitoriness.

Apr 10, 2024, 10:18 AM

|

|

Russia is making us trannies.

Trannies are Russian!

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

|

|

|

|

|

Hall of Famer [21978]

TigerPulse: 100%

Posts: 8616

Joined: 9/11/11

|

to be fair though

Apr 10, 2024, 11:01 AM

|

|

"we" are conditioned to "freak out" at this news, because this news drives monetary policy in the West.

monetary policy drives our centrally planned economy.

"we" are just rowers of the boat shooting the breeze at the proverbial coffee pot.

the market, is freaking TF out, lol.

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

|

|

|

|

|

CU Medallion [56158]

TigerPulse: 100%

Posts: 31668

Joined: 8/27/02

|

Because Volcker raised interest rates as high as 20% in 1981.***

1

Apr 10, 2024, 11:26 AM

|

|

|

|

|

|

|

|

Oculus Spirit [97800]

TigerPulse: 100%

Posts: 64927

Joined: 7/13/02

|

In response to 16% inflation. (old calculation btw)

Apr 10, 2024, 12:40 PM

|

|

If we use that same old calculation, we would have hit a CPI of almost 20% in 2022. BUT, we now have much more "accurate" data, so inflation never topped 10% because we changed the definition, and as such rates were never raised over 5.5%.

It doesn't matter the metric you use, as long as you use it consistently. That chart I posted, you could flip it around, and go back in time using current CPI metrics, and that 16% inflation in 1981 would not have been higher 8%.

|

|

|

|

|

|

All-In [40946]

TigerPulse: 100%

Posts: 42961

Joined: 11/30/98

|

Sell!!!!!!!***

Apr 10, 2024, 11:43 AM

|

|

|

|

|

|

|

|

Oculus Spirit [81130]

TigerPulse: 100%

Posts: 56208

Joined: 9/13/04

|

Why would you sell when the market drops?

Apr 10, 2024, 6:07 PM

|

|

Thats completely opposite.

|

|

|

|

|

|

All-In [47795]

TigerPulse: 100%

Posts: 30446

Joined: 11/15/99

|

-$11,800+ today

Apr 10, 2024, 5:39 PM

|

|

Thanks Jooe_

|

|

|

|

|

|

Oculus Spirit [81130]

TigerPulse: 100%

Posts: 56208

Joined: 9/13/04

|

Why did you sell today?

Apr 10, 2024, 6:06 PM

|

|

Today seems like a good buying day.

|

|

|

|

|

|

All-In [47795]

TigerPulse: 100%

Posts: 30446

Joined: 11/15/99

|

No selling. That was an unrealized loss.***

Apr 10, 2024, 6:08 PM

|

|

|

|

|

|

|

|

Oculus Spirit [81130]

TigerPulse: 100%

Posts: 56208

Joined: 9/13/04

|

So you didn't lose anything.

Apr 10, 2024, 6:16 PM

|

|

Since today is Wednesday, and that's when my 401K usually buys, it sounds like I finally timed the market right.

|

|

|

|

|

|

Replies: 46

| visibility 351

|

|

|

to award

the award.

to award

the award.